Weekends Reads: the Wind Makes Norway Poorer and Bill Ackman's Not So Great Summer

Also: Old Alpha in ETF Bottles, Homebuilders As Options Traders, Index Idiocy, and Walz's Net Worth.

Norway’s Pension Fund Global Returns 2.1% in Q2; Asset Value Rises to $1.69T

This was driven entirely by equities (27.9%), and mostly by US Tech (the picture below is from their 1H conference presentation) which provided an 8.59% gain for 1H 2024. while fixed-income investments (-0.6%) and private renewable energy infrastructure (-17.7%) dragging performance down.

This is some insider info: they are exploring allocations to external hedge funds, specifically long/short, low-net, market neutral, long-biased, and TMT specialists.

Their current active managers roster includes Algebris Investments, Amwal Capital Partners, Coeli European, Ellerston Capital, High Ground Investment Management, Kernow Asset Management, Landseer Asset Management, Laurium Capital, Manchester Global Management, Neuberger Berman and Squadra.

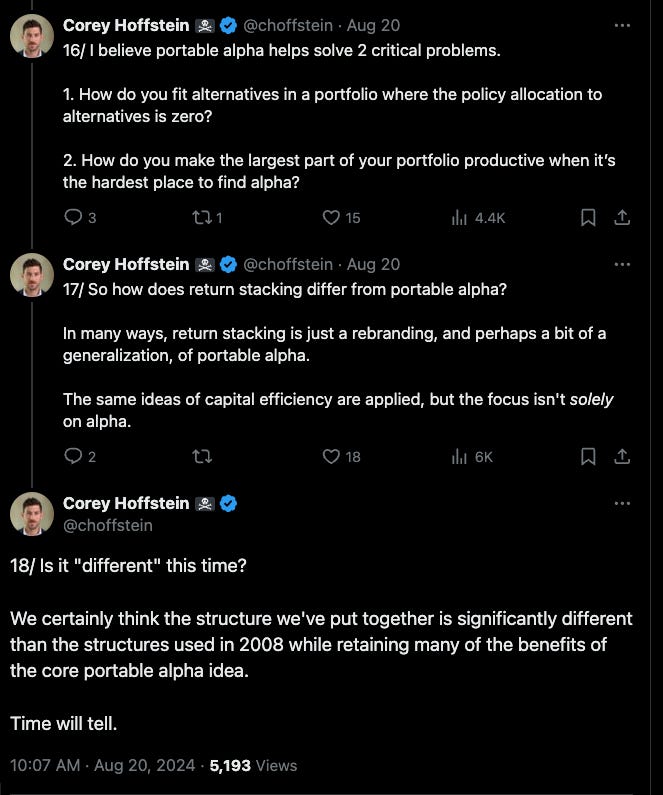

Levered Trade That Blew Up in 2008 Gets a $600 Million ETF Redo

This is old portable alpha in a new ETF bottle. Though in this case its proponents argue that old portable alpha idea was correct, but its implementation was wrong and the ETF wrapper solves the implementation problems.

The Summer of Bill Ackman’s Discontent

Activist-Man is straight up not having a good time. A US. fund IPO was thwarted, and multiple investments in his concentrated portfolio facing serious setbacks and stock declines, while his bet on falling interest rates with swaptions exacerbating his losses. Poor billionaire.

“How the Homebuilder Cartel Drives High Housing Prices”

Matt Stoller makes it seem like these are conspiring to buy up all the land (evil laughter here) and lots of other dumb takes here but what he doesn’t say is that ‘homebuilding’ has always been 2 businesses, a standalone construction business and, an investment business that speculates on land values.

The wiki pages also list RE ‘trades’ by the 2 largest builders so these are really permanent capital RE shops with RE development units attached.

Big Tech Dominance Is Forcing Index Superpowers to Rethink Rules

Idiotic.

Tim Walz Is Richer Than His Net Worth Suggests

His financial situation is an example of how traditional pensions can create hidden wealth, as his net worth doesn't properly capture the value of his pensions from his work as a teacher, soldier, and elected official. He even had enough cushion to draw $135,000 from his Congressional retirement plan last year to pay for his daughter's college, without devastating his nest egg.