Patrick McKenzie and Ricki Heicklen discuss the intricacies of teaching trading, particularly focusing on the pedagogical approaches used to develop trading skills. Ricki, a former quantitative trader at Jane Street Capital, emphasizes the importance of hands-on learning and understanding market microstructure, adverse selection, and liquidity. The conversation highlights the challenges of acquiring trading knowledge outside of professional environments and the value of simulations and practical exercises in developing effective trading strategies.

Eva Shang, co-founder and CEO of Legalist, talks about founding a successful alternative credit fund specializing in litigation finance. Legalist uses technology to scrape judicial data and identify promising litigation cases to fund, offering plaintiffs the financial support needed to pursue their claims against well-funded defendants.

Concerns are rising about over-allocation to private markets, which could lead to liquidity risks and inflated valuations.

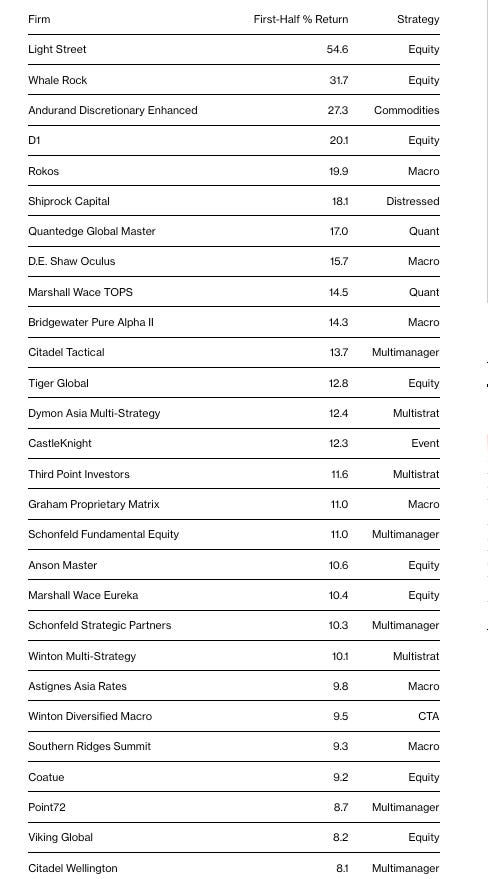

They had us in the first half: Hedge Fund Giants Poised for One of Best Years Amid Strong Start

Hedge funds experienced a bifurcated performance landscape in H1 2024, with tech-focused equity funds and quantitative strategies leading the pack while macro traders struggle. This divergence highlights the ongoing tension between fundamental stock-picking and macro-driven investing in an era of AI-fueled tech rallies and interest rate volatility. The outperformance of multi-strategy giants like Citadel and Point72 suggests that size and diversification remain potent advantages, even as specialized tech funds like Light Street and Whale Rock capitalized on the narrow leadership of mega-cap tech stocks. This year's performance dispersion underscores the increasing importance of strategy selection and manager differentiation in a market where traditional correlations are breaking down and the easy money of the post-2008 era is giving way to a more complex, volatile environment. Let’s see what happens in 2H.

I am more endowed than you

The annual endowment returns horse race has begun but comparing performance across institutions remains flawed. Asset owners face pressure to report eye-catching one-year numbers, despite insisting longer-term results matter more. This myopia ignores crucial differences in reporting standards, risk tolerances, and institutional goals. The "Endowment Olympics" lack consistent rules, with some reporting stale private market valuations while others delay to include updated figures. Suggestions to improve comparisons include contextualizing returns with risk metrics and having objective third-party reporting. Ultimately, the obsession with short-term relative performance distracts from endowments' true purpose: providing stable, long-term support for their institutions' missions.

There are just too many rich Americans

The number of accredited investors is surging due to a market gains, inflation, and antiquated regulations, granting more Americans access to the once-exclusive realm of private markets. This democratization of alternative investments is driven by a confluence of individual investor appetite and asset managers' hunger to gather assets. But the influx of retail money into private markets raises questions about the quality of offerings and the wisdom of joining a club that's rapidly losing its exclusivity. The tension between democratization and potential exploitation in this space echoes broader themes of financial innovation and regulatory lag in modern markets.

Why the CrowdStrike bug hit banks hard

CrowdStrike’s Falcon bug revealed how regulatory compliance and security monocultures can create systemic vulnerabilities in critical financial infrastructure, with a configuration error in kernel-level software causing widespread disruption across the banking sector. This incident highlighted the tension between the desire for comprehensive endpoint monitoring and the risks of concentrating critical functions in a single point of failure, while also exposing the fragility of increasingly digitized financial systems. The fallout from the bug demonstrates how quickly modern financial infrastructure can revert to informal, trust-based networks when formal systems fail, underscoring the importance of resilience and diversity in both technological and social systems supporting our economy.

Buy my course to become a millionaire! (by selling it to others)!

IM Academy exemplifies the intersection of financial speculation, multi-level marketing, and digital-age snake oil, exploiting the aspirational fantasies of young, financially naive individuals. The company's meteoric rise during the pandemic reveals both the power of social media-driven FOMO and the regulatory lag in addressing evolving forms of financial exploitation. IM faced increased scrutiny, and its pivot to religious overtones and its attempts to distance itself from individual recruiters highlight the adaptability of MLM structures in the face of legal challenges, while also underscoring the enduring appeal of get-rich-quick schemes in an era of perceived financial nihilism.

What Marketers Need to Know When Their Agencies Act as ‘Principals’

Ad agencies are increasingly engaging in principal-based trading, where they buy and resell ad inventory, rather than acting solely as agents for their clients. This practice can reduce costs but raises concerns about potential conflicts of interest and the quality of ad placements. Now marketers need to establish clear guidelines and maintain transparency with their agencies to manage these risks effectively. Despite the benefits, such as access to exclusive data products, the industry remains divided on the overall value and ethical implications of principal-based trading.

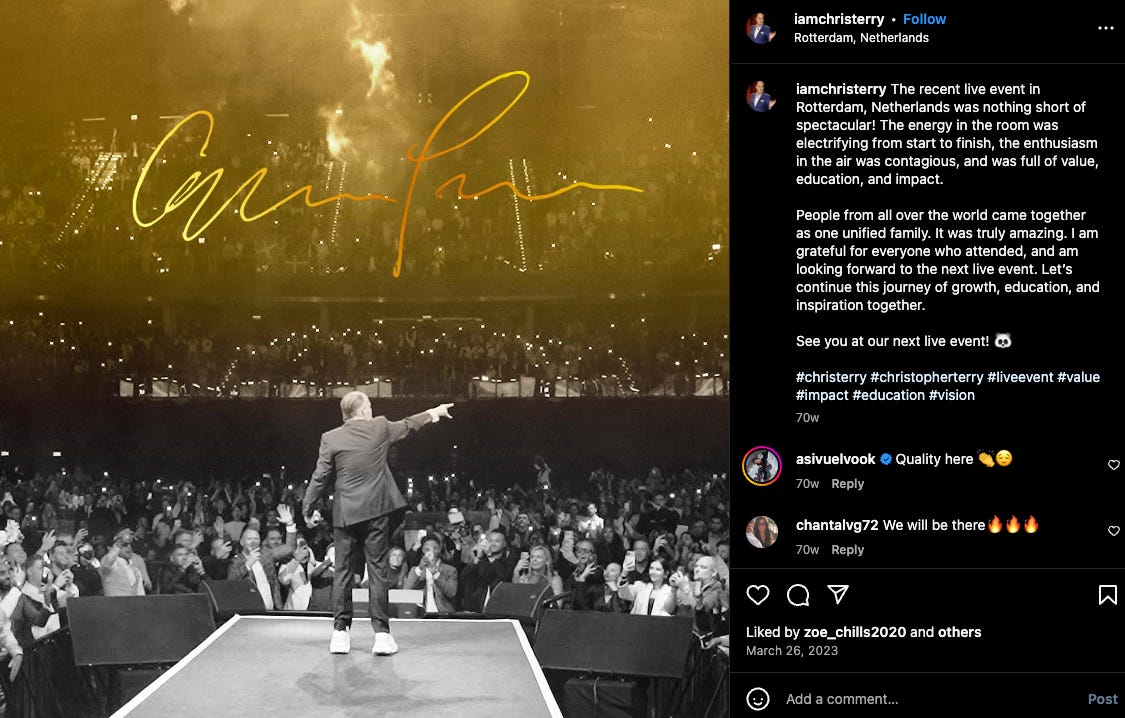

TikTok Spending Drove Microsoft’s Booming AI Business

Microsoft's AI cloud business is booming, with TikTok as a surprising kingmaker. TikTok was spending $20 million monthly on Azure OpenAI Service as of March, accounting for 25% of the service's revenue. This alliance highlights the fluid dynamics of the AI arms race, where today's customer could be tomorrow's competitor. TikTok's hefty investment is aimed at developing its own AI capabilities, presents both a windfall and a risk for Microsoft. The tech giant now faces the challenge of diversifying its AI customer base beyond fickle tech upstarts to more stable enterprise clients. This situation encapsulates the broader tensions in the AI industry: the race for capabilities, the blurring lines between collaborators and competitors, and the high-stakes gamble on future market dominance.